Getting My Frost Pllc To Work

Examine This Report on Frost Pllc

Table of ContentsNot known Facts About Frost PllcLittle Known Questions About Frost Pllc.The Buzz on Frost PllcLittle Known Facts About Frost Pllc.Little Known Facts About Frost Pllc.

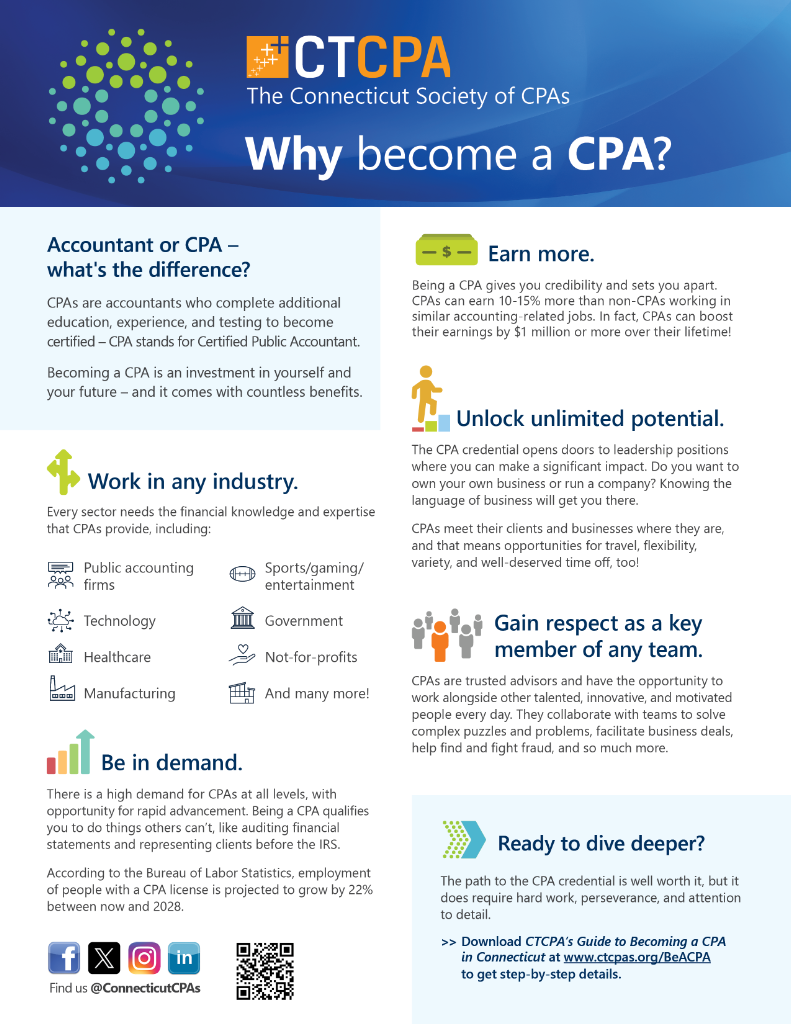

CPAs are among one of the most trusted careers, and permanently factor. Not just do Certified public accountants bring an unparalleled degree of understanding, experience and education to the procedure of tax obligation planning and managing your cash, they are specifically educated to be independent and unbiased in their job. A certified public accountant will aid you secure your passions, pay attention to and resolve your worries and, equally vital, provide you assurance.In these defining moments, a certified public accountant can supply even more than a basic accounting professional. They're your trusted advisor, guaranteeing your service stays economically healthy and lawfully safeguarded. Hiring a neighborhood CPA company can favorably influence your organization's financial health and success. Here are five essential advantages. A local certified public accountant firm can help in reducing your service's tax worry while guaranteeing compliance with all suitable tax regulations.

This development reflects our commitment to making a positive influence in the lives of our customers. Our dedication to quality has actually been identified with multiple honors, including being called among the 3 Best Accountancy Firms in Salt Lake City, UT, and Ideal in Northern Utah 2024. When you work with CMP, you enter into our family members.

What Does Frost Pllc Do?

Jenifer Ogzewalla I've functioned with CMP for several years now, and I have actually truly appreciated their knowledge and performance. When auditing, they function around my routine, and do all they can to preserve continuity of personnel on our audit. This conserves me time and power, which is very useful to me. Charlotte Cantwell, Utah Festival Opera & Music Theatre For a lot more inspiring success stories and responses from entrepreneur, visit this site and see exactly how we've made a distinction for services like your own.

Below are some crucial questions to guide your choice: Examine if the CPA holds an active certificate. This assures that they have actually passed the needed tests and meet high honest and specialist criteria, and it shows that they have the certifications to manage your monetary issues sensibly. Confirm if the certified public accountant uses solutions that line up with your business requirements.

Little organizations have special economic requirements, and a Certified public accountant with relevant experience can give even more customized advice. Ask concerning their experience in your sector or with organizations of your dimension to guarantee they recognize your details difficulties.

Clear up exactly how and when you can reach them, and if they use regular updates or assessments. An obtainable and receptive certified public accountant will be important for timely decision-making and support. Employing a regional CPA company is even more than just contracting out financial tasksit's a clever financial investment in your organization's future. At CMP, with offices in Salt Lake City, Logan, and St.

The smart Trick of Frost Pllc That Nobody is Discussing

An accountant who has actually passed the CPA test can represent you prior to the IRS. CPAs are certified, accounting experts. Certified public accountants may function for themselves or as part of a company, relying on the setting. The expense of tax obligation preparation may be reduced for independent professionals, however their experience and ability may be less.

Examine This Report about Frost Pllc

Handling this duty can be an overwhelming task, and doing something wrong can cost you both monetarily and reputationally (Frost PLLC). Full-service certified public accountant companies know with filing requirements to ensure your service follow government and state legislations, along with those of financial institutions, capitalists, and others. You might need to report added income, which might require you to file a tax obligation return for the initial time

team you can rely on. Call us for even more details concerning our services. Do you comprehend the bookkeeping cycle and the actions associated with ensuring proper financial oversight of your organization's financial wellness? What is your business 's lawful framework? Sole proprietorships, C-corps, S companies and partnerships are taxed in different ways. The even more complex your income resources, venues(interstate or worldwide versus local )and industry, the a lot more you'll need a CPA. CPAs have more education and learning and go through a strenuous qualification procedure, so they cost greater than a tax preparer or accountant. Typically, local business pay in between$1,000 and $1,500 to work with a CPA. When margins are tight, this expenditure may beunreachable. The months gross day, April 15, are the busiest time of year for CPAs, followed by the months before completion of the year. You may need to wait to get your concerns addressed, and your income tax return can take longer to complete. There is a restricted variety of Certified public accountants to go about, so you might have a tough time locating one especially if you have actually waited up until the last minute.

Certified public accountants are the" big weapons "of the accounting industry and usually do not manage daily audit jobs. Usually, these various other types of accounting professionals have specialties throughout locations where having a CPA certificate isn't needed, such as management audit, nonprofit audit, expense accounting, federal government accounting, or audit. As an outcome, utilizing an accountancy services business is frequently a much better worth than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial continuous effortsAdministration

Brickley Riches Monitoring is a Registered Financial Investment Advisor *. Advisory services are only offered to customers or possible clients where Brickley Riches Monitoring and its agents are properly certified or excluded from licensure. The details throughout this site is only for informational functions. The material is created from resources thought to offer exact info, and we perform sensible due diligence testimonial

however, the information contained throughout this web site undergoes transform without notification and is not devoid of mistake. Please consult your financial investment, tax, or lawful advisor for assistance concerning your individual scenario. Brickley Wide Range Management does not offer lawful suggestions, and nothing in this web site will be construed as legal recommendations. For more details on our firm and our consultants, please see the current Type ADV and Component 2 Sales Brochures and our Client Partnership Recap. The not-for-profit board, or board of supervisors, is the legal regulating body of a not-for-profit company. The participants of a not-for-profit board are accountable for recognizing and imposing the lawful needs of an organization. They also concentrate on the high-level strategy, oversight, and accountability of the company. While there are numerous prospects worthy of joining a board, a CPA-certified accounting professional brings a distinct anonymous skillset with them and can function as a valuable source for your not-for-profit. This direct experience gives them understanding into the habits and techniques of a strong managerial team that they can then show the board. Certified public accountants additionally have expertise in developing and developing business policies and procedures and assessment of the functional demands of staffing models. This provides them the special skillset to analyze management teams and offer referrals. Trick to this is the ability to recognize and interpret the nonprofits'annual economic declarations, which offer understandings into how a company creates income, just how much it Read Full Article costs the organization to operate, and just how successfully it handles its contributions. Frequently the financial lead or treasurer is tasked with taking care of the budgeting, forecasting, and evaluation and oversight of the monetary info and financial systems. One of the benefits of being an accountant is working closely with members of various companies, including C-suite execs and various other decision makers. A well-connected certified public accountant can take advantage of their network to assist the company in various strategic and getting in touch with functions, successfully linking the organization to the suitable candidate to fulfill their demands. Following time you're seeking to fill a board seat, think about reaching out to a certified public accountant that can bring worth to your company in all the methods provided above. Intend to find out more? Send me a message. Clark Nuber PS, 2022.